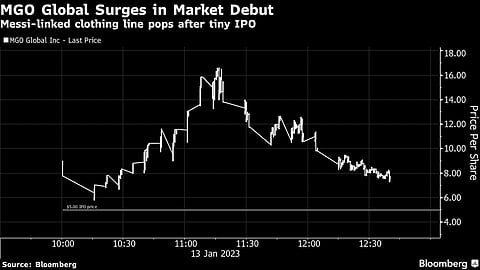

Soccer star Lionel Messi’s clothing brand is seeking to price its initial public offering this week, hoping a new year and the glow of Argentina’s World Cup victory will spark demand on Wall Street.

The striker’s casual clothing line, The Messi Brand, is produced by MGO Global, which seeks to price 1.5 million shares at $5 a piece and join the Nasdaq Stock Market this week. At that price, the venture will have a market capitalization of $66 million.

MGO is led by Ginny Hilfiger, who co-founded MGO in 2018 after a long stint revamping the FILA Global brand. Hilfiger is the younger sister of Tommy Hilfiger, for whom she has held various executive positions. MGO styles itself as a lifestyle brand portfolio that will house multiple lines from various celebrities, although Messi is the only active line from the venture right now.

Hilfiger works closely with the Argentine striker to design the Messi Brand’s line of parkas, hoodies, graphic T-shirts and other casualwear, including gear featuring designs of the Argentine’s flower and crown tattoos. The prospectus says it produces “clothing that is as technically advanced as Messi’s style of play on the field,” through use of various weaves and materials. The MGO license with the seven-time Ballon d’Or winner excludes all sports footwear—Adidas has those rights—as well sports technical gear. Also excluded are pajamas, bath linens, backpacks and other items directed to children under 13, according to the filing.

Messi isn’t a shareholder in the business. Instead, he receives 12% of Messi Brand sales with a minimum guarantee of €4 million over the three-year global licensing agreement that ends in December 2024. MGO has no guarantee the license may renew at that time.

So far, The Messi Brand business is relatively small: MGO sold $336,103 worth of goods in the nine months through September 2022, with a net loss of $2.1 million, according to the prospectus. It focuses on social media and influencers to drive visits to its online Messi store.

The offering is led by Boustead Securities, an Irvine, Calif., brokerage that brought Esports Technologies public in 2021.